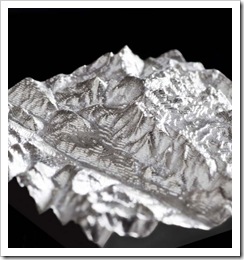

When the bank of China announced that ordinary Chinese should invest in silver, as an option to gold. Unveiling newly minted bars and coins with a fanfare fire cracker display, on state television. Investors around the world woke up to the fact silver was on the way up.

At the same time ordinary Chinese citizens were public ally encouraged to go to their bank and trade their dollars's into mini silver bars, and coins. In India silver traders were seeing a slow switch from gold to silver by ordinary Indians in the bazaars.

Silver values on global markets jumped up to its highest in 31 years, as China, the Worlds forth highest producer of this precious metal, announced no more silver was going to be exported. Whilst experts admitted there was a global shortage of silver.

Shortages create higher prices, and the fact that nations still holding US dollar bills, fear that quantitative easing (printing money) by the US treasury is continuing to devalue the greenback. Gold, Silver and other precious metals can be bought with these extra dollars, and in turn ensure no future dollar losses in the future, as the sale of silver can be made in a local currency.

De-coupling from the greenback has been a gradual process since the 2008 market crash, and involves a continued process of buying assets with these extra dollars. This seems to be the strategy of China, and much of the developed World. But there is another reason why silver prices are rising. Silver is needed in a wide range of Industrial products, as well as for Jewellery products such as rings and bracelets. A shortage of silver is simply driving the price up.

High gold prices are also reason silver is becoming a more valuable precious metal. In many countries, people tend to buy gold as an investment, especially jewellery. Since there is less trust in the US dollar, and the Euro, consumers seeing high gold prices, are now opting for silver.

The Chinese investor, Indian housewife and global manufactures, are the three main reasons silver could be the new gold for the next few years. And this trend also helps less developed countries which suffered because of a formerly artificially low silver price.

Silver can be freely traded through most national banks, or coin shops. Online users can purchase silver coins and mini-bars through eBay, and a wide range of silver stores. Silver coins like the American Eagle or Kennedy dollar, also make great gifts, and aid local businesses who sell them.

Discover how to Adjust to economic change.

By Mark W. Medley

No comments:

Post a Comment